12 Years Experienced

Smart Payment for All Industries

Streamlining Processing, Simplifying Success!

Premier Merchant Services

Discover how PayPlacement offers an extensive array of tools and services tailored for any business.

Business Solutions

Our team of skilled professionals will support you through any project you envision.

Trusted and Strategic Partners

Partnering with PayPlacement means more than just a transaction; it’s a commitment to trusted collaboration and strategic growth

Merchant Account

Get Your High Risk Merchant Account

Pre-approved

CBD

As the leading CBD payment processor, we specialize in securing swift approvals for both emerging ventures and established enterprises, ensuring seamless access to sustainable CBD merchant accounts.

Adult

We provide a diverse array of adult merchant account solutions catering to various high-risk businesses. Whether it's adult toys or membership sites, count on us as your premier adult credit card processor,

Vape Merchat Account

If you’re looking for a vape merchant account, look no further. We are experts at getting fast approvals for vape payment processing accounts at competitive rates.

Pawn Shop

Transitioning your sales from storefront to online demands a pawn shop merchant account. With seamlessly integrated payment gateways, we empower you to elevate your business swiftly and efficiently.

Credit Repair

Empower your credit repair business with our essential merchant accounts, while we handle seamless payment processing. Focus on delivering credit solutions while we take care of transactions effortlessly

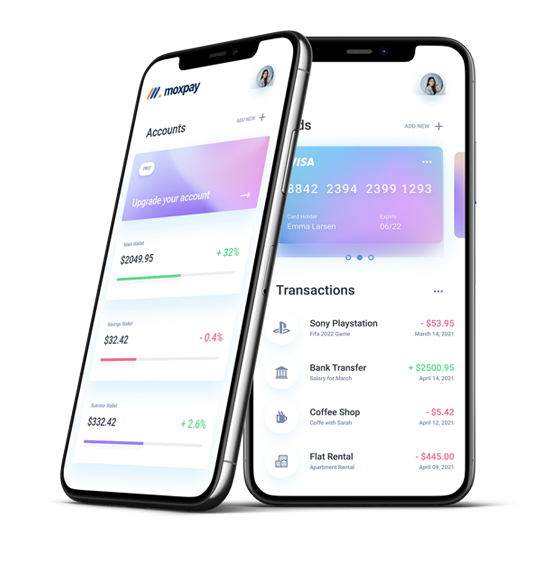

Ecommerce Integrations

Running an ecommerce store comes with inherent risks. Whether you face high chargebacks or manage a subscription billing model, our tailored merchant accounts provide the necessary support to mitigate these challenges effectively.

What is a high risk merchant account?

A high risk merchant account is designed for businesses categorized as high risk, necessitating specialized payment processing solutions. These industries demand tailored approaches to facilitate online credit card transactions effectively.

High Risk Accounts

A high risk merchant account is a type of payment processing account for unique businesses. High risk merchants who choose to process with instant approval companies may have their account shut down which can lead to lost revenue. Understand more about being in high risk verticals by researching payment review websites with key information.

To get a high risk merchant account you need to look for a payment processing company that works with your industry. PayKings understands your businesses unique needs and will work with you each step of the way.

Beyond underwriting and approval, your payment processor should help keep your high risk business operating smoothly. Our partners can help you with fraud prevention, chargeback protection and gateway integration.

You need a high risk merchant account if other payment processors conisder your company high risk. Many payment processors make the distinction in their Terms and Conditions. Some of the reasons include the folllowing:

- High Chargeback Rates - If your company has too many chargebacks or reaches a certain threshold, you may be high risk.

- Chances of Fraud - Certain companies or industries have increased fraud levels. Know your industry and secure your business from different kinds of online scams and theft.

- Recurring Payments - Do you offer consistent monthly payments or bill automatically after a trial offer? There are merchant accounts specifically for these types of billing systems.

Our high risk payment gateway and direct network of 20+ banks and PSP's provides the connections you need to run your ecommerce store. It works with most POS systems so you can keep your existing terminal.

The payment gateway shares information from your merchant account and the customer's bank account. It's an online interface that connects the two parties at checkout. Be sure to understand all of the regulations involved with your gateway and find out how to make the ecommerce process as streamlined as possible.

MERCHANT ACCOUNT

Your merchant account enables you to receive online payments from customers utilizing both credit and debit cards. Paired with a payment gateway, you gain the capability to enhance your website sales through a high-risk credit card processing account tailored to your business needs. Serving as bank accounts for your business, merchant accounts can vary in number depending on your business size, each carrying distinct fees and restrictions.

MERCHANT ACCOUNT FEES

Merchant account fees fluctuate based on industry, sales volume, and business background. Our dedicated team of underwriters conducts a thorough assessment of your business, tailoring a bespoke merchant account to suit your specific requirements. During consultations, we outline standard fees and account functionalities. Typically, longer processing histories and higher sales volumes equate to lower account risk levels. To secure the most competitive rate, part of the application process entails sharing comprehensive company details.

Real People. Real Relationships.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Happy Client

Merchant

Official Partner

Country

HIGH RISK PAYMENT GATEWAY

PayPlacement provides payment solutions tailored for businesses operating in high-risk industries. As payment processing providers, our banks assume liability for the elevated risk associated with these businesses requiring high-risk merchant accounts. Our high-risk payment gateway enhances the safety and security of high-risk credit card processing, incorporating integrated fraud prevention solutions to mitigate chargebacks effectively.

HIGH RISK CREDIT CARD PROCESSING

Determining if your business requires high-risk credit card processing typically stems from other merchant accounts declining to undertake associated risks. The acquiring bank or its representatives reserve the right to close your account and withhold funds abruptly, based on negative risk factors tied to your product or brand. Additionally, if you encounter significant chargeback rates or if your payment processor terminates your account, obtaining a high-risk merchant account becomes essential for enabling online credit card payments.

HIGH RISK MERCHANT ACCOUNT PROVIDERS

Discover the ideal high-risk merchant account provider by understanding key criteria. Whether your ecommerce platform specializes in CBD oil, adult items, or credit repair services, ensure your merchant account aligns perfectly with your business requirements. Opt for an integrated payment gateway offering stable and scalable credit card processing, ensuring your website is primed for seamless transactions.

CBD Merchant Account

Securing a CBD merchant account is vital for both new ventures and established businesses within this rapidly expanding industry. With mainstream merchant account providers discontinuing services in this legally regulated sector, obtaining a lasting solution is imperative to facilitate credit card transactions and online CBD sales. While certain regulations persist, high-risk CBD merchant accounts are specifically tailored to accommodate this unique product.

Whether you specialize in edibles, flowers, or CBD products for pets, our payment processing solutions are designed to support your business growth. While CBD payment processing entails limitations, demonstrating limited THC content and avoiding unsupported medical claims by the FDA is crucial. Fortunately, meeting these requirements ensures smooth access to credit card processing for your CBD business.

Insight

Latest Article

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!